U. S. Charitable Tax Mitigation Strategies

Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver. And God is able to bless you abundantly, so that in all things at all times, having all that you need, you will abound in every good work. 2 Corinthians 9:7-8 NIV

It’s easy to imagine that since you are reading this that our opening scripture describes not only your heart but also your personal experience in giving. Saying “thank you” simply doesn’t capture our gratitude for all you have done for TIBI, but also for the many other charities which you have had a part. We are well aware that personal contribution and support come in many forms. A kind word, a recommendation of sponsorship, hands-on supporting a local effort or writing a check are all very important to make this world a better place and advance the Kingdom of God.

There are numerous ways individuals have supported our mission. Our experience has led us to establish this webpage in order to share a couple of ideas which we hope will help you when you contemplate charitable giving. The two areas which we think contributors can benefit most from are simple tax mitigation strategies and legacy giving–ideas which should lead to a discussion with your tax preparer or financial planner ensuring that you are getting the most out of your charitable resources. We are not tax or financial advisors, but we have seen the strategies others have used and hope that this simple review will be a blessing for you — especially considering how you have been such a blessing to us.

By the way, thank you!

The most important step:

Talk with your family. Share with them the organizations you contribute to and why. “Train up a child…..” — you’re a giving person and likely your family members are too. Helping them understand how you selected these organizations will help them make similarly good choices in the future. Probably the best way you can teach them how to bless others is by personal example. Share with them the joys of giving as well as the successes of the organizations you’ve supported. Say “look what God is doing with the contribution we made to TIBI. Someday you will meet a person in heaven who is there because we helped.” Truly someday you will!

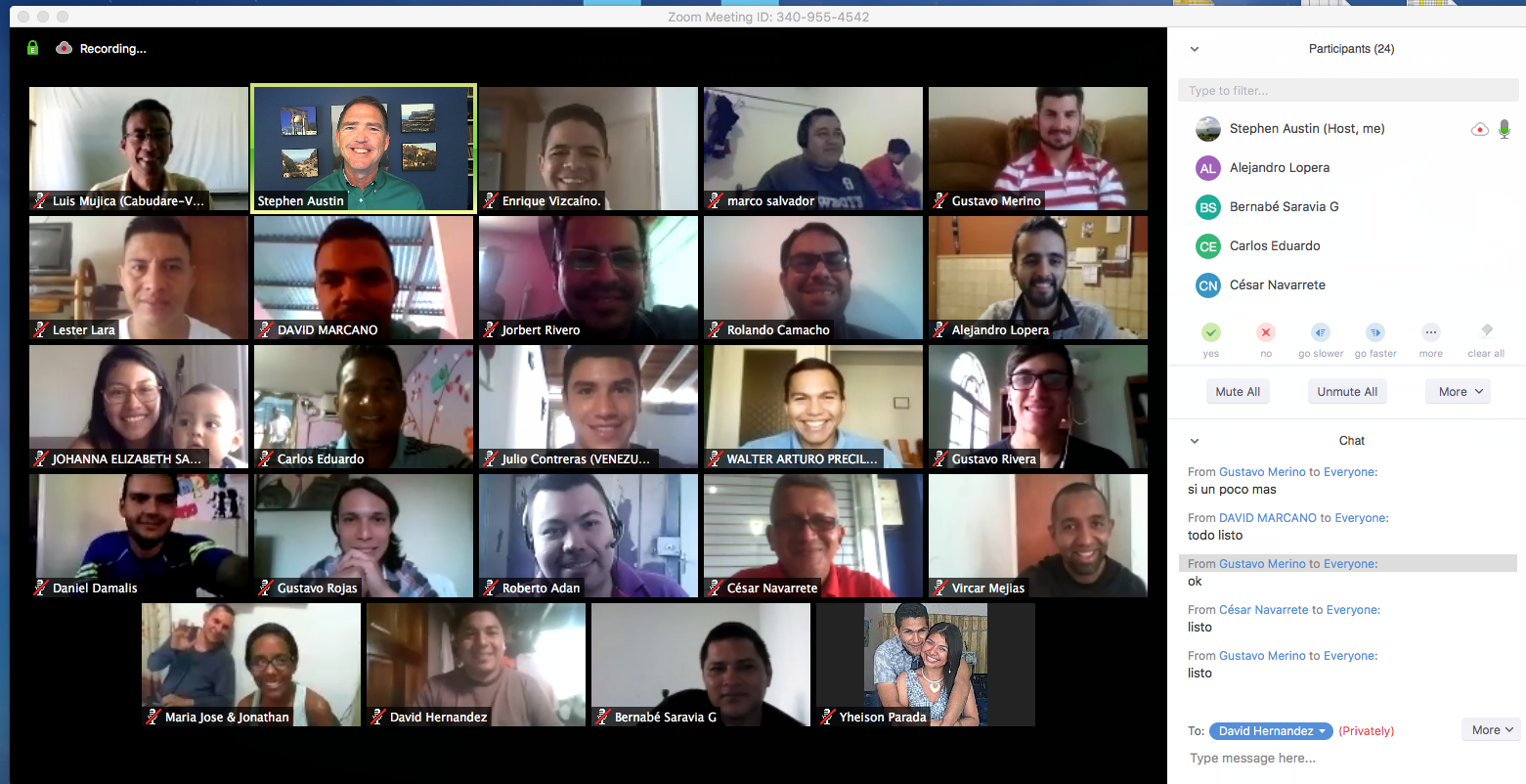

This is our classroom: Dr. Steve Austin leads a class of dedicated students via ZOOM. No more brick and mortar–just people eager to learn.

Got internet? If so, quality Christian education has come to your hometown.

Got electricity? Worldwide satellite internet is becoming an affordable reality.

Tax Mitigation

[disclaimer: Because the tax code is complicated and changes over time, it is strongly recommend that you consult your tax, financial, and estate planning advisors before deciding on a charitable giving strategy.]

Donation of Stock/Appreciated Assets: Many charitable organizations (like TIBI) accept donations that are not cash. The benefit of donating stock is that you don’t have to pay the taxes on the appreciated value AND you get the full market value (if held at least one year) of your donation as a deduction. Let’s assume you bought XZX for $10,000 and its now worth $25,000. If you donate XZX to TIBI you will get a $25,000 contribution deduction on your taxes and won’t have to pay tax on the $15,000 it appreciated. If you had sold it and given cash you would have a $15,000 taxable gain to report. Either way, the charity gets $25,000 — but your tax situation can be very different depending on how you choose to contribute. Some contributors repurchase the donated stock and also gain by resetting their cost basis. The deduction limit is 60% of your AGI. (Adjusted Gross Income)

Donation Bunching: Bunching is a way to take advantage of the IRS standard deduction. Depending on your situation you could benefit with this method by giving multiple years’ worth of charity in one year and then not giving in the following year(s). In the giving year you maximize the itemized deduction by greatly increasing your charitable donations. In the following year you take the standard deduction with little to no donations. Maximizing this strategy would need to include all charities (church, TIBI, Make-A-Wish, etc.). Not everybody is in a position to make such a large contribution. Some don’t like the idea of giving a large amount and then not giving for the following year (to church for example). But it’s easy and it works for those who typically itemize their deductions.

Donor Advised Fund (DAF): The DAF is a great tool to take advantage of both bunching and the donation of appreciated assets. Like everything else, it has its rules and you need to be aware of them as follows:

- You can only deduct certain contributions to a DAF up to 30% of your AGI.

- Donated securities need to have been held for at least one year to take advantage of their full market value.

- Donations to the DAF are irrevocable–once deposited in the DAF, they are considered donated to charity and can only be distributed to IRS-qualified charities.

The DAF advantage is that you can give to a charity by making a “grant” to them and you can do so whenever you like and as often as you like. You can also set up a recurring grant which pays every month. It’s easy to use and the grant will go to your charity in the form of a check. (It’s works similarly to an on-line bill pay.) There is no time limit on when you must grant your DAF account and it could sit idle (invested) for years. When you die, the remaining assets will either be reassigned to a grantor of your choice (who will control future grants) or it may be distributed to the named 501(c)(3) beneficiaries you selected. You set up the successor or beneficiary when you create the account.

The DAF triple benefit:

- You don’t pay taxes on the capital gains from the donated stock.

- You get a tax deduction for the full market value of the donated stock.

- You can buy the same stock (repurchase) for your portfolio effectively resetting its cost basis which will reduce its taxable liability on its subsequent sale.

Consider the cost of not using this strategy: The higher your income, the greater the tax advantage gained by donating appreciated assets. If you’re in the 15% capital gains tax bracket and you donate the stock in the donation of appreciated asset example above, you will save $2250 in taxes by not having to realize the capital gain versus giving cash to your charity. Either way you would also get a $25,000 tax deduction which would be worth an additional $8000 in tax savings if you are in the 32% tax bracket. That’s effectively a $10,250 tax reduction on a $25,000 gift which you originally bought for $10,000.

Qualified Charitable Distribution (QCD)

Generally speaking, QCDs are a way of giving to a qualified charity directly from your Individual Retirement Account (IRA) without generating income for yourself and can also satisfy a Required Minimum Distribution (RMD). The maximum annual exclusion is $100,000 for those who are 70½. The funds must transfer directly from your IRA to the charity. If you have an inherited IRA (any age) the benefit of an QCD for an RMD can be significant especially considering the recent IRS 10-year inherited IRA RMD rule. Your financial planner can help you determine the best way to utilize this strategy.

Legacy Gifts

Please understand the importance of legacy giving with family. Your heirs might perceive this as giving away their inheritance, but if you explain your wishes ahead of time they will support it as a part of the family’s philanthropic nature. Let them know it is important to you to establish a legacy gift supporting what matters most to you.

Last Will: In most circumstances, when you die your assets will pass through probate. Your Last Will is submitted and after a period of time your assets will be distributed according to your wishes. You can make a specific bequest to individuals or a charity, but if you bequeath specific amounts there can be complications. For instance, your estate value might change significantly by then. If you make specific bequests, it is suggested that you review your Last Will annually. If you choose to make changes to your Last Will, it will likely require the assistance of an attorney. However, not all of your assets will pass through probate. Your named beneficiaries of life insurance policies, IRAs, 401-Ks, other retirement plans, annuities, etc, will receive those benefits outside of probate. Because of that, you might find it easier to give to your charities accordingly.

CLT: A Charitable Lead Trust (CLT) will provide a charity with the income flow it generates and then distribute the remainder to you or your beneficiary when it expires. There are two types of CLT (Grantor and Non-Grantor) with differing tax consequences. Because of this, it is recommended that you contact a professional to help you set up the trust as well as justify a tax strategy that best suites your situation.

CRT: A Charitable Remainder Trust (CRT) will provide you with an income flow while you are alive and then the remainder is awarded to your charity upon your passing. Some people who have assets they don’t need for retirement have chosen to set up a CRT and use the income stream to pay for a whole life insurance policy. Upon their death the life insurance pays their heirs while the trust goes to the charity creating a legacy.

Remember TIBI, please

We could not operate without your support. Hopefully you see supporting TIBI as an investment in the Kingdom of God as it affects people all around the world. Our objective is teaching the Bible while also providing additional ministerial skills which will lead to a life of ministry. Our curriculum includes textual study, Biblical languages, counseling, research, expository speaking, and Biblical history and geography. TIBI is fiscally lean and uses every dollar for TIBI. Some of our full-time students have scholarship grants from TIBI that cover not only their education but also their living expenses. They study and work with a church furthering their ministerial skills, rather than working odd jobs to feed their family. Additionally, we provide mentoring and training in their practical local work through a full-time field work supervisor. Our students are set up in home/church classes at their current locations, keeping them within their own culture, so that they can immediately use what they learn.

We’ve been doing distance learning since 2005. Internet access and technology continue to expand and are truly taking us to the far reaches of the world. In areas where internet access is unreliable, we have distributed our classes preloaded on flash drives. We have seen God bless the efforts of these men and women over and over.

Do you like numbers?

- TIBI grads have planted over 75 new churches.

- TIBI students have reported over 5500 baptisms.

- We present more than 60 courses every year via live video conferencing .

- Our on-line video programs have more than 1530 students from 76 different countries.

- Our YouTube channel has over 13,300 subscribers and more than 1.4 million views.

- In Cuba, we have more than 2270 students taking courses with hard/flash drives where internet is sparse. Over 16,500 have taken at least one course and are even using WhatsApp as a teaching platform.

Our students are deeply appreciative of the training, education and networking they receive through their relationship with TIBI. It’s people like you and your family who have made this possible. It has been exciting to watch God bless TIBI through time; who knows what is yet to come! May all our actions bring Him glory. May we all have His Kingdom on our hearts.

God bless you for making a difference!

Please use this information to start a discussion with your financial planner.

DONATE TO TIBI HERE

Most financial organizations have a charitable branch. The following are hyperlinked for your quick access: Fidelity, Schwab, Vanguard.

AETH is the main certifying agency of Spanish-speaking seminaries in the United States. As of October 2020, our Bachelor of Ministry and Biblical Studies is certified and permits our graduates to apply for graduate studies at any seminary.

AETH is the main certifying agency of Spanish-speaking seminaries in the United States. As of October 2020, our Bachelor of Ministry and Biblical Studies is certified and permits our graduates to apply for graduate studies at any seminary.

Guidestar, the world’s leading source of information about non-profit organizations, awarded TIBI its highest rating in 2023, the Platinum Seal of Transparency. Less than 1% of non-profits earn this rating.

Guidestar, the world’s leading source of information about non-profit organizations, awarded TIBI its highest rating in 2023, the Platinum Seal of Transparency. Less than 1% of non-profits earn this rating.